February 1, 2024

Investigations pursuant to section 337 of the Tariff Act of 1930 at the United States International Trade Commission (“ITC”) determine “whether there is unfair competition in the importation of products into, or their subsequent sale in, the United States.”1 Section 337 investigations are also known as unfair import investigations, and usually include allegations of patent infringement and trademark infringement by imported goods.2 Other allegations of unfair competition may include infringement of registered copyrights, misappropriation of trade secrets, false advertising, and antitrust claims.3 The ITC also conducts import injury investigations under Title VII of the Tariff Act of 1930, which includes antidumping and countervailing duty (“AD/CVD”) investigations and five-year reviews of existing AD/CVD orders.4 AD/CVD investigations involve determining “whether there is material injury or threat of material injury to the domestic industry by reason of the dumped [(i.e., sold in the US at less than fair value)] or subsidized imports.”5 The ITC can also investigate a variety of trade matters under section 332 of the Tariff Act of 1930.6

This article will provide an overview of the events of 2023 at the ITC, with a focus on section 337 investigations involving consumer goods and pharmaceuticals, legislative activity that would—if enacted—change the requirements for establishing a domestic industry, and reports published by the ITC. This article will then highlight two investigations to watch in 2024.

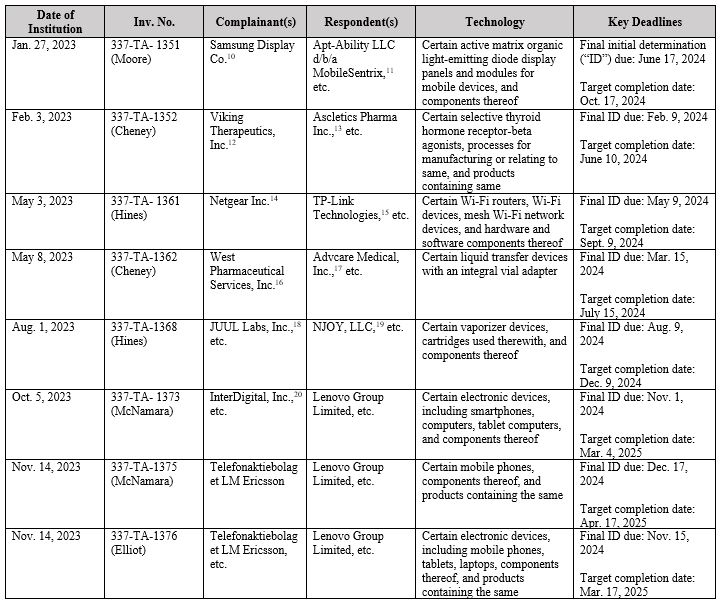

In 2023, the ITC had 107 active section 337 investigations (as of October 12, 2023).7 33 new section 337 investigations were instituted in 2023. Of the cases instituted in 2023, 13 involved patents covering semiconductors/memory, circuits/measuring and testing, optics/photocopying, printing/measuring and testing; 12 involved patents covering computers, communication, and e-commerce technologies; 17 involved patents covering “other,” which includes biotechnology and organic chemistry; chemical and materials engineering; networking, multiplexing, cable, and security; transportation, construction, electronic commerce, agriculture national security, and license and review (and more); and 8 involved patents covering mechanical engineering, manufacturing and medical devices/processes. Since 2020, the patentee involved in the greatest number of ITC investigations is Telefonaktiebolaget LM Ericsson, the Swedish communications technology company,8 and the patent challenger involved in the greatest number of investigations is Lenovo Group Limited, the technology company.9 The following is a selection of section 337 investigations involving consumer goods and pharmaceuticals the ITC instituted in 2023.

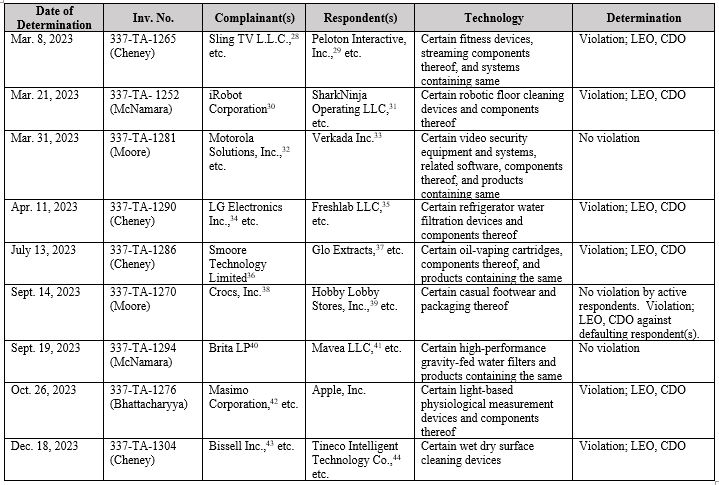

The primary remedy in a section 337 investigation is an exclusion order directing United States Customs to stop infringing imports from entering the country.21 There are two types of exclusion orders: a limited exclusion order (“LEO”) which “bars the importation of products by specific respondents determined by the [ITC] to be violating section 337,” and a general exclusion order (“GEO”) which “bars the importation of all violative products, regardless of source, where it is necessary to prevent circumvention of an exclusion order limited to violative products of named persons or where there is a pattern of violation and it is difficult to ascertain the source of the violative products.”22 The Commission may also issue cease and desist orders (“CDO”) “against named importers and other persons engaged in unfair acts that violate Section 337.”23

Taking into consideration all section 337 investigations in which the Commission rendered a final determination on the merits as to a violation, the average length of an investigation was 17.1 months in 2022,24 with the shortest length of 5.5 months and the longest length of 27.42 months.25 The average length of investigations reached its second-highest point in the last approximately 17 years26 in 2020, at 18.6 months.27

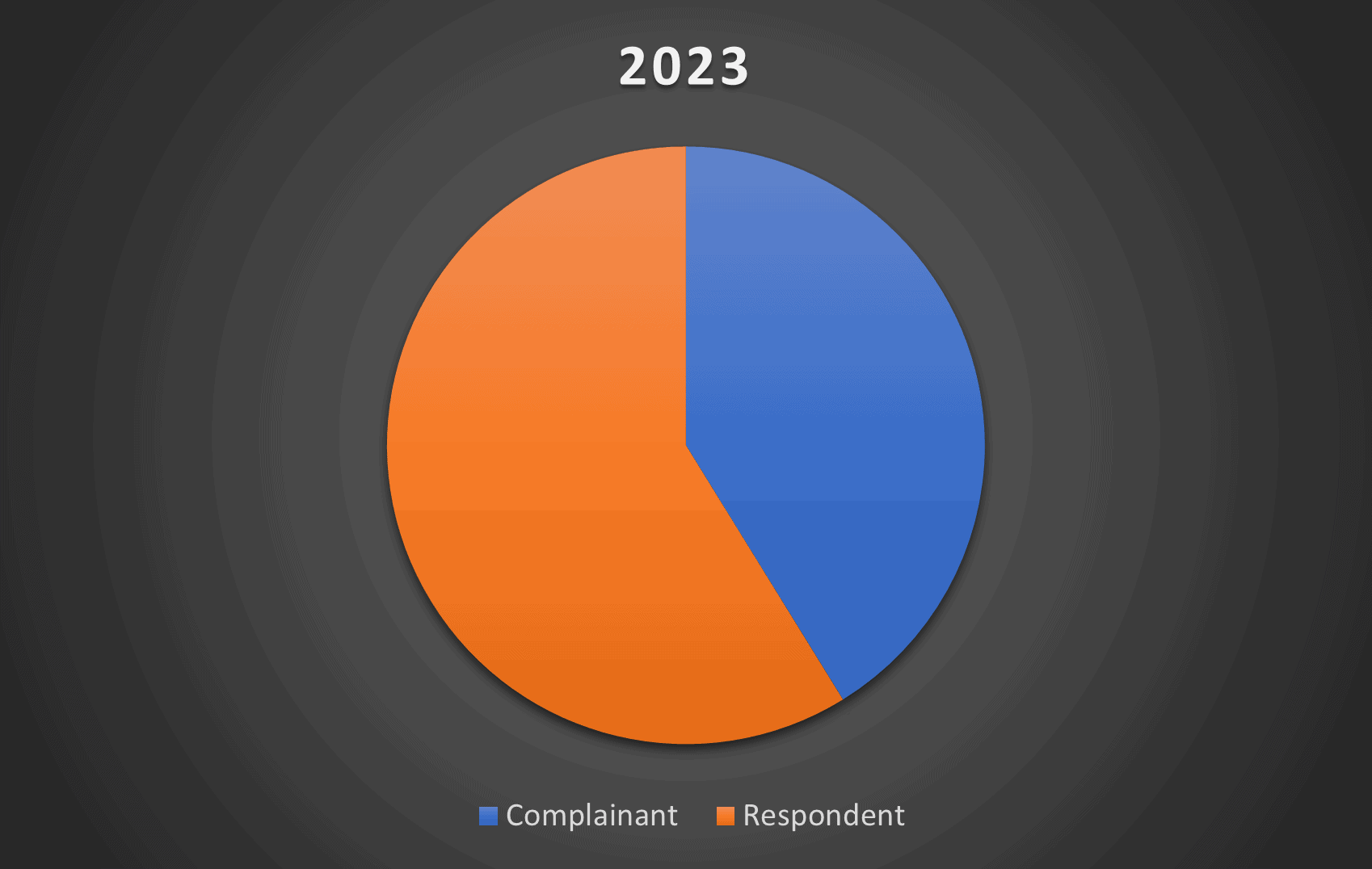

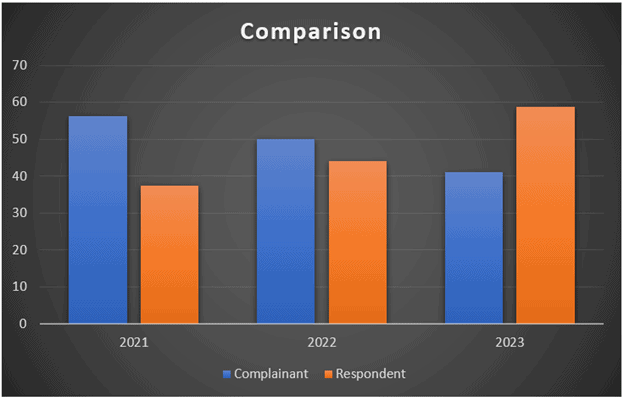

With respect to cases decided in 2023, the complainant won 41.2 percent of the time and the respondent won 58.8 percent of the time.

This represents a shift from previous years; in 2022, the complainant won 50 percent of the time and the respondent won 44.1 percent of the time, and in 2021, the complainant won 56.3 percent of the time and the respondent won 37.5 percent of the time.

Following are a sample of the decisions issued in section 337 investigations in 2023.

On May 18, 2023, the Advancing America’s Interests Act (“AAIA”) was re-introduced in the House by Representatives David Schweikert (R-AZ) and Don Beyer (D-VA).45 One criticism of the ITC is that its power is abused by patent trolls who buy patents for financial gain and target American companies to stifle competition.46 The AAIA would, among other things, attempt to target this problem by changing the domestic industry standard to require “a complainant attempting to demonstrate domestic industry through licensing activities to show that those activities led to the adoption and development of articles that incorporate the patent, copyright, trademark, mask work, or design at issue.”47 In other words, a company “whose only industry is licensing (no research, development, or manufacturing) must show that its patent has led to the adoption of development of products that actually incorporate the patent.”48

Relating to domestic industry, the AAIA would also “eliminate the ability of a complainant to subpoena an unwilling company to meet the domestic industry standard requirement.”49 The AAIA would additionally place heightened emphasis on the public interest by requiring the ITC to “affirmatively determine that any exclusion serves the public interest.”50

In March 2023, the ITC conducted an all-day hearing on the World Trade Organization’s pending decision on extending the waiver of IP rights for COVID-19 technologies, formally known as the Agreement on Trade-Related Aspects of Intellectual Property Rights (“TRIPS”).51 This hearing was part of the ITC’s investigation on the topic which culminated in a 497-page report released on October 18, 2023.52 While the report did not make any recommendations, it “ultimately did not find any definitive evidence that IP rights present a barrier to access in the context of COVID diagnostics and therapeutics.”53

Also in March 2023, the ITC published a report entitled “Economic Impact of Section 232 and 301 Tariffs on U.S. Industries.”54 In 2018, new tariffs were imposed on imports of steel and aluminum products and a large range of products imported from China.55 The report was written to provide “a retrospective analysis of U.S. trade, production, and prices in the industries directly and most affected by any section 232 or section 301 tariffs that were active as of the date of enactment (March 15, 2022) of the Consolidated Appropriations Act, 2022.”56 The report found, for example, that section 232 tariffs reduced imports of covered steel and aluminum products by an estimated 24.0 percent and 31.1 percent on average, respectively.57 The report also found that “as a result of the tariffs, U.S. production of steel and aluminum increased by 1.9 percent and 3.6 percent on average, respectively, during this period.”58 Among other findings, the report concluded that the “tariffs appear to explain a relatively large portion of the declines in steel and aluminum imports during 2018-2021.”59

In May 2023, the ITC published the Recent Trends in U.S. Services Trade: 2023 Annual Report, covering “recent trends in U.S. services trade and developments in services industries’ competitiveness,” with a particular focus “on developments in U.S. trade in distribution services.”60 Distribution services includes, in particular, “transportation, wholesale and retail, and logistics services.”61 Among other findings, it reported that in 2021, “[t]he United States was the world’s largest cross-border exporter of commercial services,” “supplying $771.9 billion (12.9 percent) of global exports.”62 In addition, “[f]rom 2017 to 2021, U.S. service-supplying industries increased real output by 10.5 percent, from $12.4 trillion to $13.7 trillion,” displaying a faster growth rate than goods-producing industries.63

On March 8, 2023, in Investigation No. 337-1265, the ITC issued a LEO prohibiting unlicensed entry of fitness devices, streaming components thereof, and systems containing same by Respondents ICON Health & Fitness, Inc., FreeMotion Fitness, Inc., NordicTrack Inc. (collectively, “iFit”), and Peloton Interactive, Inc. (“Peloton”); and CDOs against iFit and Peloton.64 Complainants are DISH DBS Corporation, DISH Technologies, LLC and Sling TV LLC (collectively, “DISH”).65 After this decision, Peloton and DISH entered into a $75 million settlement which included DISH requesting the import ban against Peloton to end.66 The ITC voted and on June 1, 2023, agreed that the ban should lift as to Peloton; this did not affect the ban as to iFit.67 iFit has since appealed the ban against it to the Federal Circuit, and submitted its opening brief on November 21, 2023.68 DISH’s response brief is currently due March 3, 2024.69

Also, on October 26, 2023, the ITC issued a LEO and CDO against Apple, Inc. (“Apple”) in Investigation No. 337-1276, prohibiting the unlicensed entry of infringing wearable electronic devices with light-based pulse oximetry functionality and components thereof manufactured by or on behalf of Apple or any of its affiliated companies, parents, subsidiaries, or other related business entities, or its successors or assigns.70 Complainants are Masimo Corporation and Cercacor Laboratories, Inc.71 The remedial orders include an exemption for service or repair or, under warranty terms, replacement of products purchased prior to the end of the period of Presidential review.72 Apple announced that it would stop selling particular Apple watches in response to this ruling.73

Apple then appealed to the Federal Circuit, and the ITC rejected Apple’s request to pause the ban pending the appeal process.74 The Federal Circuit had temporarily paused the ban until it decided whether to grant Apple’s motion requesting that the ban be paused for the entire appeal process.75 Thus, Apple resumed sales of its watches with blood oxygen sensors.76 However, on January 17, 2024, while the Federal Circuit did not issue a ruling to overturn the ITC decision, the Federal Circuit did lift the injunction that blocked the ban.77 Thus, Apple is now banned from importing the Apple Watch Series 9 and Ultra 2—both containing blood oxygen sensors—through the pendency of the appeal.78

777 South Flagler Drive

Phillips Point East Tower, Suite 1000

West Palm Beach, FL 33401